Financial Literacy Trainings (FLT) in Uganda Provides Participants with Basic Skills in Budget, Investment, Savings, Loans, Insurance, Personal Financial Management, Cash Management, Retirement Planning (planning for old age), and Spending.

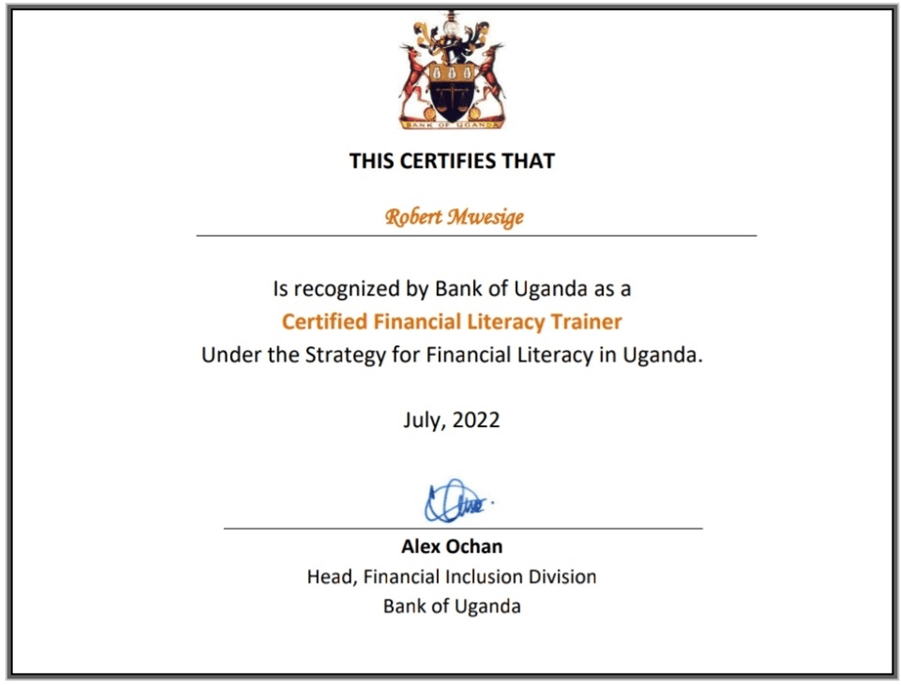

Financial literacy is the ability to understand and effectively use various financial skills, including, We Have Certified Financial Literacy Trainers of Bank of Uganda and We Follow Financial Literacy Pillar 1 And the Strategy for Financial Literacy from The Bank of Uganda.

Managing Money for Adults is very important for employees. Let them Learn how to make the most of their money and learn the skills they need to navigate the complex world of personal finance. In this course, we train your staff and they learn to budget effectively, taking into account changes like getting older and leaving the family home and retirement from a job.

They will also understand how to choose and manage savings accounts, and discover how to borrow sensibly and manage debts effectively. Ultimately, every participant will gain the ability to plan and make your goals financially achievable.

With our financial literacy training, we empower your employees to Take control of their financial future by learning how to manage their money. Financial Literacy is a course that does not exist in the curriculum in Uganda. It’s also sad to note that those at the age of 18+ are one of the age groups most likely to be in debt.

Throughout this Financial Literacy Training Course, we will explore interesting and relevant real-world examples of managing your money so that you can better understand all the underlying concepts. This training provides practical, ready-to-use solutions to use in life both at work and at home or wherever you may be.

We offer a full suite of a financial literacy program with various modules which consists of multiple learning sessions that start with basic information and progress to more complex aspects of the topic. We understand that Financial literacy means; …having the knowledge, skills, and confidence to manage money well. That’s why we aim to give the three important elements of the definition.

We give you the “Knowledge” which means having an UNDERSTANDING of personal financial issues

You’ll also gain the “Skills” and be able to APPLY that knowledge to manage your personal finances

You’ll have the “Confidence/Attitude” which means FEELING SUFFICIENTLY SELFASSURED to make decisions relating to your personal finances

Participants will learn:

Personal Financial Management (PFM)

Get a deeper understanding of personal financial management by gaining an understanding of your financial situation to make the most of your assets in day-to-day life and in planning for your future. Personal finance is a term that covers managing your money as well as saving and investing. It encompasses budgeting, banking, insurance, mortgages, investments, retirement planning, and tax and estate planning.

Savings

We learn how income not spent, or deferred consumption is set aside for emergencies, investment, and the future. We shall look at some of the methods of saving like putting money aside in, for example, a deposit account, a pension account, an investment fund, or cash. Saving also involves reducing expenditures, such as recurring costs. Savings, therefore, teaches us how to arrive at a net surplus of funds for an individual or household after all expenses and obligations have been paid.

Loan Management Best Practices

People continue to borrow for different reasons. That’s why it is important to include this topic in the program for any financial literacy training intervention. There are mostly three reasons why one of the participants or someone they know may be having a loan.

The loan might have been acquired to invest or to respond to an emergency or even to consume (to purchase an item for which he or she did not have enough money). Participants need to understand Key things to consider while obtaining any loan like Institutions, products, terms, and conditions, when to borrow and when not to borrow, Interest rates, Other costs, and collateral.

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed.

Investment

Investment means to allocate money with the expectation of a positive benefit/return in the future. In other words, we learn how you can own an asset or an item to generate income from the investment or the appreciation of your investment which is an increase in the value of the asset over a while.

Financial Literacy Training also aims to create more investors and that’s the reason we cherish the topic of investment. “Investing is putting your money to use to allow it to grow”. An investment can be in form of property such as livestock (cows, goats, pigs), land (rental apartments, buildings), business market stalls, grocery shops, or shares, bonds, and government securities from which you can earn profits”. Investment is the driver for the creation of wealth and financial security.

Retirement Planning

Retirement is the withdrawal from one’s position or occupation or one’s active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are old or incapable of doing their job.

It is quite clear that retirement planning hasn’t changed all that much over the years. You work, you save and then you retire. But while the mechanics may be the same, today’s savers are facing some challenges that previous generations didn’t have to worry about.

To have a comfortable, secure as well as a fun retirement, you need to build the financial cushion that will fund it all. The fun part is why it makes sense to pay attention to the serious and perhaps boring part: planning how you’ll get there.

Insurance and Risk Management

Participants understand how the insurers carry out the assessments and quantification of the likelihood and financial impact of events that may occur in the customer’s world that require settlement by the insurer; and the ability to spread the risk of these events occurring across other insurance underwriter’s in the market.

Financial Service Providers et.al

Checking Accounts. An account at a financial institution that allows for withdrawals and deposits, Savings Accounts, Money Market Accounts, Certificates of Deposit, Mortgages, Home Equity Loans, and Personal Loans.

The Trainer: Mr. Mwesige Robert

Robert is a Financial Literacy Certified Trainer, who is recommended by Bank of Uganda as experts in carrying out Financial Literacy Training. He has not only attended the Financial Literacy Training of Trainers Workshop but have also trained hundreds of Ugandans in the subject.

More Information About Financial Literacy Training in Uganda

The Bank of Uganda (BOU) a Strategy for Financial Literacy in Uganda and will lead its implementation. The preparation of the Strategy for Financial Literacy in Uganda has benefited from the input of stakeholders during a series of stakeholder workshops and in a number of individual meetings and discussions. More information can be accessed on the simplify money website of the bank of Uganda https://simplifymoney.co.ug